kansas inheritance tax rules

The advantages of an inheritance cash advance in Kansas include. Kansas Inheritance Laws Probate Process.

Kansas City Power Of Attorney Lawyers Top Attorneys In Kansas City Ks

Fortunately neither kansas nor missouri has an inheritance tax.

. On the other hand let us consider new jersey. The probate process can be difficult and expensive so youll want to know what your options are for avoiding probate in Kansas. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Valuation is established on the day of death. Not every state has them. No need to go through a loan approval process.

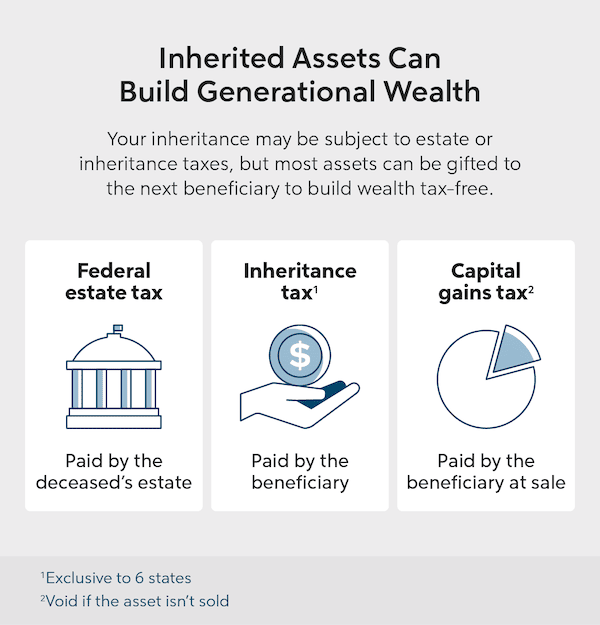

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from. The Kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased. The kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased.

In this detailed guide of the inheritance laws in. Kansas Probate and Estate Tax Laws. The Kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased.

State inheritance tax rates range from 1 up. Kansas statutes dont provide a dollar amount or percentage of the estate that may be given as payment to the executor or administrator. Hi does kansas have an inheritance tax.

However it does address the issue of compensation. The Kansas estate tax is imposed upon the taxable estate of a decedent based upon the decedents date of death. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of.

When you sell the property and home you will may be taxed on capital gains. The tax rate for deaths occurring in 2007 begins at 3 for 2008 the. Let us say the.

No need to go through a bank for the money. Inheriting a home or real estate does not trigger taxes. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which.

Listed below are some of. Once the probate case is opened in Kansas the executor is responsible for a number of duties. As well as how to collect life insurance pay on death accounts and survivors benefits and.

An immediate influx of cash. Info about Kansas probate courts Kansas estate taxes Kansas death tax.

Irs Announces 11 7 Million Exclusion For 2021 Estate Planning Attorneys In Missouri And Kansas

State By State Estate And Inheritance Tax Rates Everplans

Kansas Inheritance Law Archdiocese Of Kansas City In Kansas

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Estate Tax And Inheritance Tax In Kansas Estate Planning Weber Law Office P A

Actec Trust And Estate Talk Podcast Series

Kansas Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Last Will And Testament Legalzoom

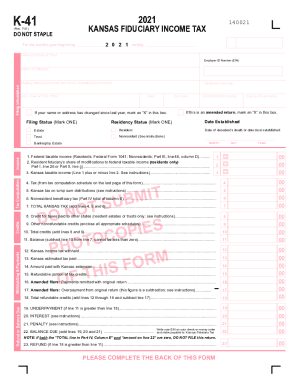

Ks Dor K 41 2021 2022 Fill And Sign Printable Template Online

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Lamar Hunt Set The Standard For Nfl Succession Plans Sportico Com

Kansas Small Estate Affidavit Explained Youtube

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return